In optical communication networks, optical modules play a crucial role. It is responsible for converting electrical signals into optical signals and converting received optical signals back into electrical signals, thereby completing the transmission and reception of data. Therefore, optical modules are the key technology for connecting and achieving high-speed data transmission.

With the development of artificial intelligence, computing power competition has become a new battlefield for wrestling between technology companies. As an important part of optical fiber communication, optical modules are optoelectronic devices that realize photoelectric conversion and electro-optical conversion functions in the process of optical signal transmission, and their performance has a direct impact on AI systems.

Optical modules have become the most indispensable hardware components of AI computing power in addition to GPU, HBM, network cards, and switches. We know that large models require powerful computing power to process and analyze large amounts of data. Optical communication network provides a high-speed and efficient data transmission mode, which is an important foundation and solid base to support this huge computing demand.

On November 30, 2022, ChatGPT was released, and since then, a global craze for big models has swept through. Recently, the Sora, a large model for cultural and biological videos, has sparked market enthusiasm, and the demand for computing power is showing an exponential growth trend.A report released by OpenAI indicates that since 2012, the computing power demand for AI training applications has doubled every 3-4 months, and since 2012, AI computing power has grown by over 300000 times. The inherent advantages of optical modules undoubtedly perfectly meet the needs of AI in terms of high-performance computing performance and application expansion.

The optical module has high speed and low latency characteristics, which can provide powerful data processing capabilities while ensuring data transmission efficiency. And the bandwidth of the optical module is large, which means it can process more data simultaneously. The long transmission distance makes high-speed data exchange between data centers possible, which helps to build distributed AI computing networks and promotes the application of AI technology in a wider range of fields.

In the past two years, driven by the wave of AI, Nvidia's share price has soared. First, at the end of May 2023, the market capitalization exceeded the trillion dollar mark for the first time. In early 2024, it reached the peak of $2 trillion in market value.

Nvidia's chips are selling like crazy. According to its recent fourth-quarter earnings report, quarterly revenue hit a record $22.1 billion, up 22% from the third quarter and 265% from the same period last year, and profit rose 769%, significantly beating analysts' expectations. In Nvidia's revenue data, the data center is undoubtedly the most shining department. According to statistics, the AI-focused division's fourth-quarter sales soared to $18.4 billion from $3.6 billion last year, an annual growth rate of more than 400 percent.

And in sync with Nvidia's remarkable growth,under the catalysis of the wave of artificial intelligence, some domestic optical module enterprises have achieved certain performance. Zhongji Xuchuang achieved a revenue of 10.725 billion yuan in 2023, a year-on-year increase of 11.23%; The net profit was 2.181 billion yuan, a year-on-year increase of 78.19%. Tianfu Communication achieved a revenue of 1.939 billion yuan in 2023, a year-on-year increase of 62.07%; The net profit was 730 million yuan, a year-on-year increase of 81.14%.

In addition to the increasing demand for optical modules in artificial intelligence AI computing power, the demand for data center construction is also growing.

From the perspective of data center network architecture, based on existing 100G solutions, meeting the non blocking network throughput of data centers of the same size requires adding more ports, more rack space for servers and switches, and more server rack space. These solutions are not cost-effective and lead to a geometric increase in the complexity of the network architecture.

Migrating from 100G to 400G is a more cost-effective way to inject more bandwidth into data centers, while also reducing the complexity of network architecture.

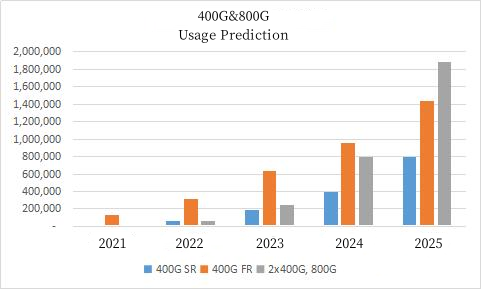

Market forecast of 400G and above speed optical modules

According to Light Counting's prediction of 400G and 800G related products, SR/FR series is the main growth product for data centers and Internet centers:

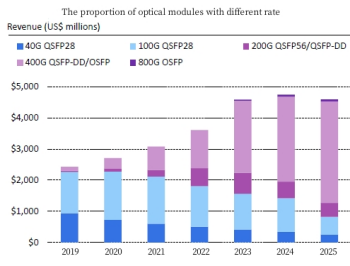

It is predicted that 400G rate optical modules will be deployed at scale in 2023, and will occupy the majority of sales revenue of optical modules (40G and above rates) in 2025:

Data includes all ICP and enterprise data centers

In China, Alibaba, Baidu, JD, Byte, Kwai and other major domestic Internet manufacturers, although the current architecture of their data centers is still dominated by 25G or 56G ports, the next generation planning jointly points to 112G SerDes based high-speed electrical interfaces.

With the continuous progress of science and technology, 5G network has become one of the hot topics in today's communication field. 5G technology will not only provide us with faster data transfer speeds, but also support more connections between devices, thus creating more possibilities for future smart cities, autonomous vehicles and the Internet of Things. However, behind the 5G network, there are many key technologies and equipment support, one of which is the optical module.

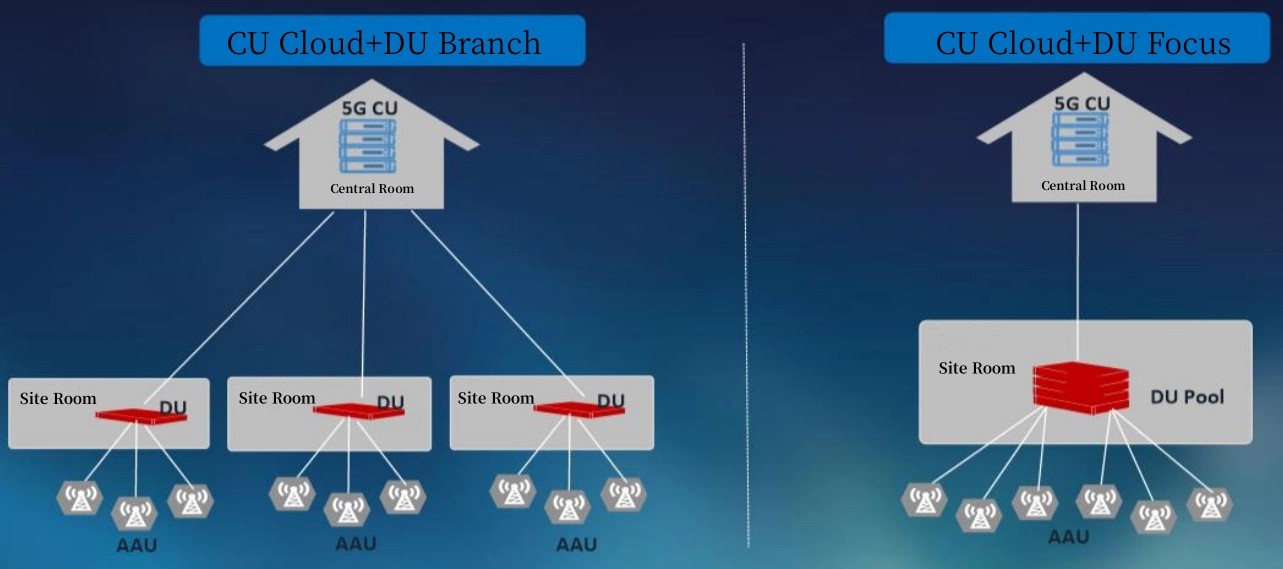

A higher bandwidth optical module will be used to connect the DU and AAU of the 5G RF remote base station. In the 4G era, BBU was the baseband processing unit of base stations, while RRU was the radio frequency unit. In order to reduce transmission loss between BBU and RRU, optical fiber connection, also known as forward transmission scheme, was often used. In the 5G era, wireless access networks will be fully cloud based, with a centralized wireless access network (C-RAN).C-RAN provides a new and efficient alternative solution. Operators can streamline the number of devices required for each cellular base station through C-RAN and provide functions such as CU cloud deployment, resource virtualization into pools, and network scalability.

5G front-end transmission will use larger capacity optical modules. At present, 4G LTE base stations mainly use 10G optical modules. The high-frequency spectrum and high bandwidth characteristics of 5G, coupled with the use of MassiveMIMO technology, require ultra wideband optical module communication. Currently, C-RAN is attempting to reduce the CPRI interface speed by migrating the physical layer of DU to the AAU section, thereby reducing the demand for high bandwidth optical modules and enabling 25G/100G optical modules to meet the ultra-high bandwidth transmission requirements of future 5G "high-frequency" communication. Therefore, in the future construction of C-RAN framework base stations, 100G optical modules will have great potential.

5G base station deployment

Increase in number: In the traditional base station scheme with a single DU connecting 3 AAU, 12 optical modules are required; Adopted morphism the demand for the base station optical module of the frequency reach technology will further increase. We assume that in this scheme, a single DU connects 5 AAU,20 optical modules are required.

Summary:

According to LightCounting, among the top ten global optical module sales suppliers in 2010, there was only one domestic manufacturer, Wuhan Telecom Devices. In 2022, the number of Chinese manufacturers on the list increased to 7, with Zhongji Xuchuang and Coherent tied for the top spot; Chinese manufacturers have increased their market share in optical components and modules from 15% in 2010 to 50% in 2021.

At present, the domestic optical module three Jiji Xuchuang, Tianfu communication and new Yisheng, the market value reached 140 billion yuan, 60 billion yuan, 55 billion yuan, of which the leading Zhongji Xuchuang from the market value beyond the previous global optical module industry first Coherent (recent market value of about 63 billion yuan), officially the world's first brother position.

The explosive growth of emerging applications such as 5G, AI, and data centers is standing on the tuyere, and the future of the domestic optical module industry is foreseeable.